The All-In-One 401(k), Payroll, Benefits, and HR Solution

69 million workers lack access to a retirement plan through their workplace.1 Paychex Flex® is our all-in-one solution for all things HR, making retirement plan management easier.

Simplify 401(k) Management with Paychex

Integrated Retirement and Payroll Services

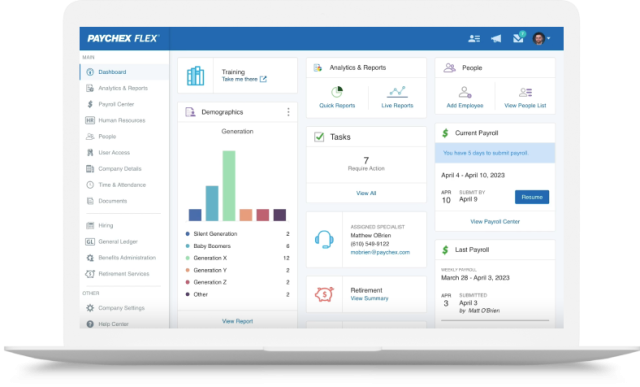

Paychex retirement services can be combined with payroll and HR services so you and your employees can easily manage employee benefits from a single sign-on platform.

Paychex Flex helps:

- Simplify plan and employee management

- Reduce errors

- Provide access to critical reports

- Save your business time and money

Affordable Employee Wellbeing

Offering a 401(k) plan with affordable and flexible contribution strategies enhances employee wellbeing by offering financial security and peace of mind, reducing stress about the future. For those employers who choose to offer matching contributions, it’s like giving employees a bonus for investing in their future.

Unlock the Power of Paychex 401(k)

As the nation's number one 401(k) recordkeeper,2 we can help you find a plan that helps employees reach their retirement goals and puts tax savings in your pocket.

Help Employees Reach Retirement Goals and Attract Top Talent

Empower your hardworking employees with 401(k) plans that build business success and help secure their financial futures. With nearly half the workforce lacking retirement savings plans,1 your commitment to their financial security makes a significant difference.

Add Value to Your Benefits Package

Round out your traditional employee benefits package with a 401(k). This supports your team’s financial wellbeing and strengthens their loyalty and satisfaction. Offering a solid 401(k) shows your employees that you care about their future as much as their present.

Tax Savings in Your Pocket – and Theirs

Take advantage of substantial tax savings while supporting your team. Under the SECURE Act, you may qualify for up to $16,500 in tax credits over three years (with eligibility and auto-enrollment).5 Take advantage of these credits and boost your benefits package – it’s a win-win for you and your team.

Flexible and Easy to Set Up

Managing retirement plans is one of the costliest HR tasks.3 With Paychex, you can choose from various options, like traditional 401(k), Multiple Employer Plan (MEP), and Pooled Employer Plan (PEP). We handle everything—from plan selection to setup, enrollment, and ongoing maintenance.

Retirement Compliance Support

Paychex helps with enrollment and participant education and provides ongoing expertise. With an MEP, you'll also get centralized oversight for compliance, ensuring all participating employers meet regulatory requirements.

Value of Paychex 401(k)

We make 401(k) administration easy for employers and employees.

80

Hours/Year

Average hours spent annually by businesses on 401(k) or other retirement plan management.3

$40,796

Average amount spent annually by businesses on 401(k) or other retirement plan management.3

4

Clicks

Needed when employees use the quick enrollment feature to sign up for a retirement plan with Paychex.

58.1%

Of Baby Boomers

Likely to own at least one type of retirement account.4

49.5%

Of Millennials

Own at least one type of retirement account.4

Why Offer a 401(k) Plan?

Supporting employees’ financial wellbeing can lead to higher productivity, better retention, and increased engagement. When employees feel cared for, they’re less likely to leave their jobs and more likely to recommend their company as an employer.

“We do care very much about our employees, and we want them to be able to save for the future. But also (use a retirement plan) for recruitment and bringing new employees in. The food service industry is tough when it comes to getting good people in, and having that one extra benefit to be able to offer them makes a big difference.”

Simplify Retirement Plan Management with Paychex Flex

Watch our demo to see the power of Paychex Flex step by step.

For more information on the benefits of combined payroll and retirement services, contact a Retirement Services specialist.

Find the Best Retirement Plan for You and Your Employees

Access the all-in-one solution that simplifies retirement plan management and supports employee financial wellbeing.