We Make It Easy to Comply with CA’s Retirement Mandate

Get Started Today

Fill out our form and we’ll contact you to discuss how a retirement plan can benefit your business.

Action Plan for Small Businesses

CA Retirement Deadline

- $250 fine after 90 days past the deadline

- Additional $500 if you’re still non-compliant after 180 days

Know Your Options

- Start a professionally managed 401(k) plan from a provider such as Paychex

- Register with CalSavers, the state’s retirement savings program

- File for an exemption and get the requirement waived

We're Here To Help

As a leading 401(k) recordkeeper in the US2, we work with small businesses like yours every day. We can help you understand the advantages of each plan so saving for retirement is easy and affordable.

Get Tax Credits

How does a free 401(k) plan sound3 ? You may be able to have 100% of your startup costs covered for the first three years. Find out how much you could save with our SECURE Act Tax Credit Estimator.

State IRA or 401(k) Plan — Which is Better for Your Business?

To comply with CA law, you can enroll in CalSavers, the state-facilitated IRA program. Or, you can start a Paychex 401(k) plan with tax credits and other advantages.

CalSavers IRA vs. Paychex 401(k) Plan

State — IRA

401(k) (Offered by Paychex)

$7,000

$23,500

No

Yes, at employer’s discretion

Not available

Potential tax credits of up to $5,500 per year for the first 3 years.

Potential employer contribution credit of $1,000 (maximum) per employee 3

Employer processes payroll contributions, updates contribution rates, adds newly eligible, etc.

Paychex makes administration simpler as your recordkeeper

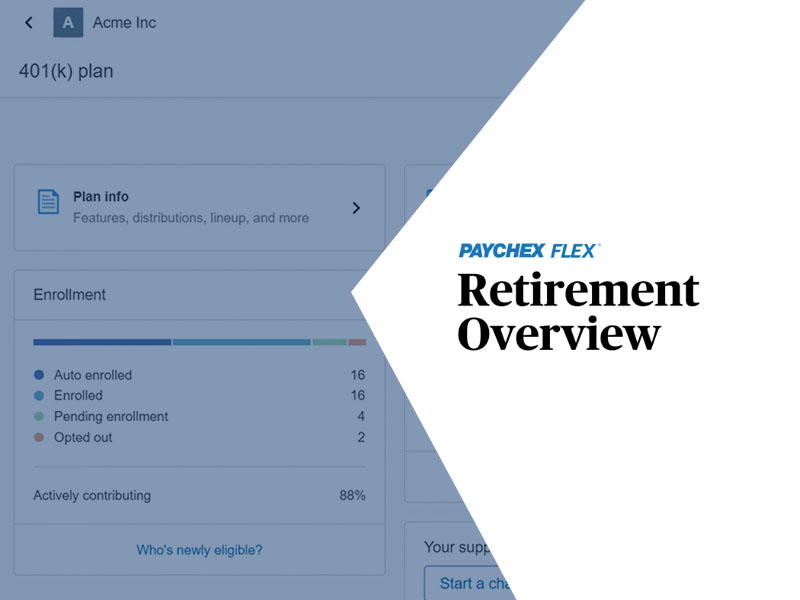

The Simpler Way To Offer a 401(k)

Offering a 401(k) plan to your employees doesn’t have to be complicated. You and your employees can start saving today with:

- Cloud-based plan management in just a few clicks

- Easy online enrollment

- Ongoing support from retirement specialists

Pooled Employer Plans (PEPs): Great for Small Businesses

A PEP can save time, reduce plan costs, and unlock valuable tax incentives while offering your employees a high-quality retirement benefit. We take on the tough stuff so you can focus on running your business.

Getting Started Is Easy

Connect With a Retirement Specialist

Schedule a consultation with a Paychex retirement plan specialist. We’ll assess your business needs, explain plan options, and help you choose the best fit.

Make Retirement-Saving Automatic With Payroll

When retirement is paired with payroll in our single, all-in-one platform, everything’s simpler. Don’t have Paychex for payroll? No problem! We can connect you to more than 100 leading payroll providers, including Paycor.

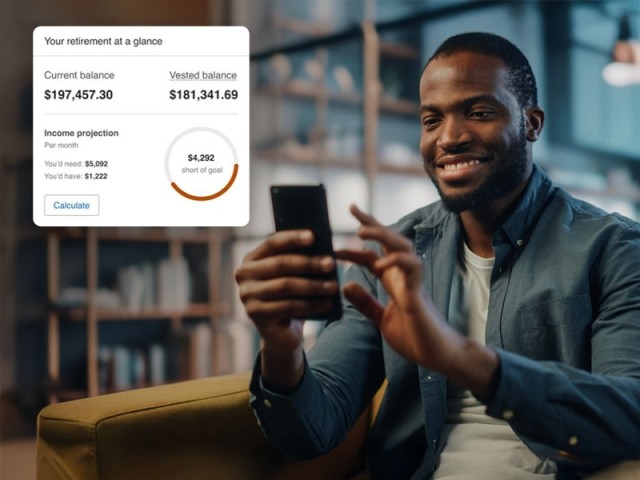

Enroll in Just a Few Clicks

With our quick enrollment, employees can join a retirement plan in just four clicks. Our tools and resources simplify everything, so your team can easily understand their options and start saving for their future.

Get Ongoing Support

Get ongoing support from our team and 24/7 access to our online Help Center. Employers and employees can access Paychex Flex® to manage plans, track eligibility, and access real-time reporting.