Enhance Your Advisory Role

As a benefit of our professional accounting relationship, you have complimentary access to specialized resources and tools to help simplify your day-to-day responsibilities, keep you up-to-date on the latest laws and regulations, and free up more of your time for value-added consultation.

See How Paychex Can Help Your Clients

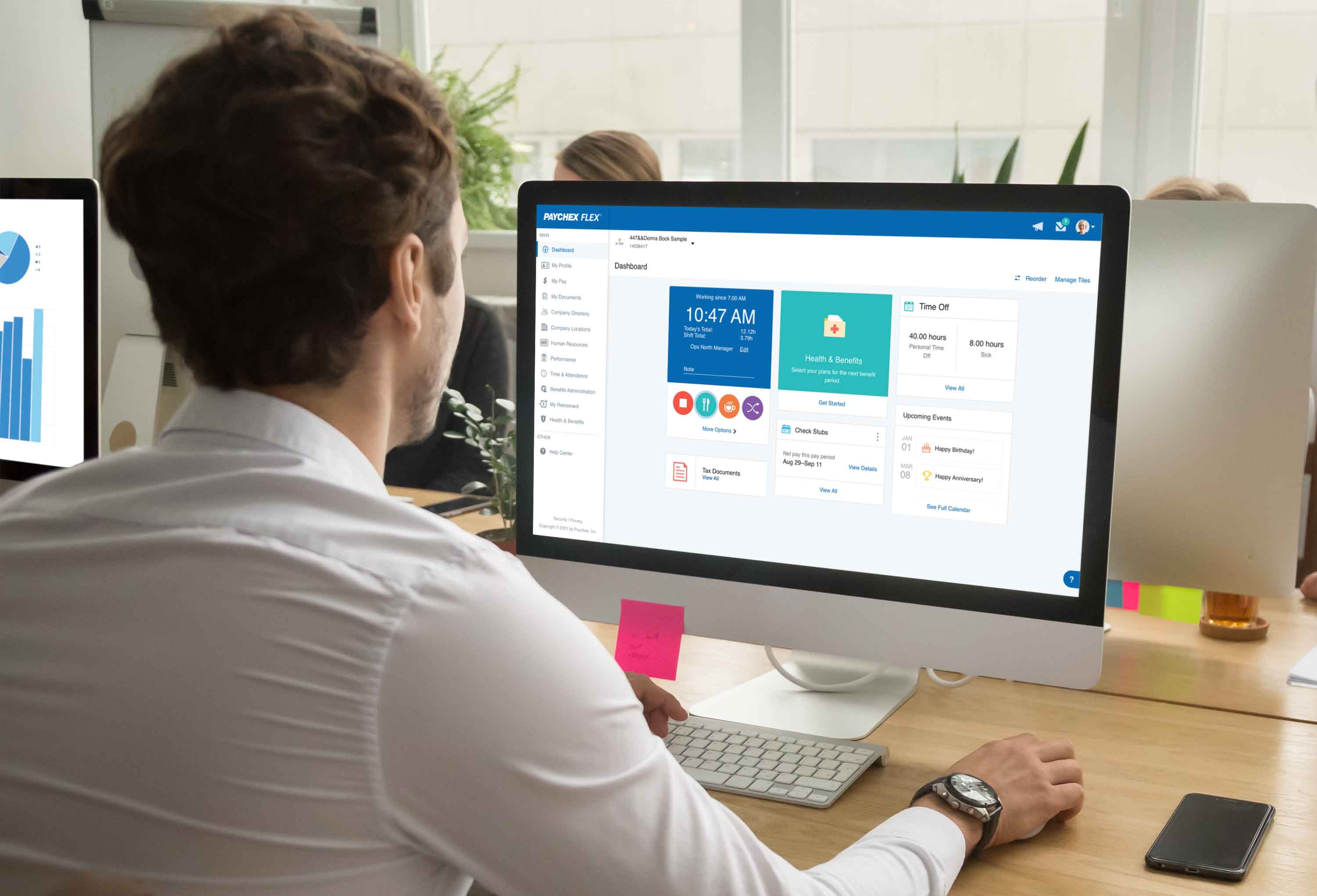

Learn how Paychex helps businesses of all sizes make HR and payroll brilliantly simple. See how our all-in-one HR software and service solution helps small to medium-sized businesses achieve their business goals as the workplace continues to change.

Accountant Resources and Tools for Members

Paychex Partner Pro

- Save time by managing clients’ payroll and HR data online from a single platform

- Accountant-specific dashboard and powerful analytics to enhance client consultations

- Extensive resource library

Register for Paychex Partner Pro

Paychex Accountant Knowledge Center

- Enhance your professional development with self-study CPE webinars

- Save time with practical resources like the client letter toolkit and downloadable tax forms

- Produced in collaboration with Wolters Kluwer

Paychex Worx Resource Center

- In-depth and downloadable articles, white papers, and eBooks

- On-demand webinars and online events

- Paychex business podcasts, hosted by CPA and author Gene Marks

Member Benefit

Are your clients asking more questions about their HR challenges? Is your firm looking for ways to increase revenue opportunities? Paychex offers solutions that can help enhance your value and enable you to focus on growth. Everyone benefits from Paychex handling the back-office administration and allows you to consult with confidence.

With your referral, your clients receive:

- One month of free payroll, HR, and retirement services

- Six-month, money-back satisfaction guarantee on payroll and retirement services*

Educate Your Clients on the Benefits of a Retirement Plan

With a traditional 401(k) or Pooled Employer Plan (PEP), your clients can gain significant advantages, including:

- Significant tax benefits

- Simplified administration

- Reduced fiduciary responsibility

- Enrollment assistance

In addition, a good retirement plan can help attract new hires and retain employees, even in a tight labor market.