BOI Reporting Requirements Temporarily Reinstated by Court

A federal district court in Texas ruled that the U.S. Treasury's Financial Crimes Enforcement Network (FinCEN) could temporarily enforce beneficial ownership information reporting requirements under the Corporate Transparency Act. However, FinCEN said it will not enforce, fine, or penalize businesses that fail to file a report by the March 21 deadline.

- Reporting companies given deadlines after March 21 for extenuating circumstances should adhere to the later deadlines

- By March 21, FinCEN plans to announce it is extending the reporting deadlines and issuing an interim final rule.

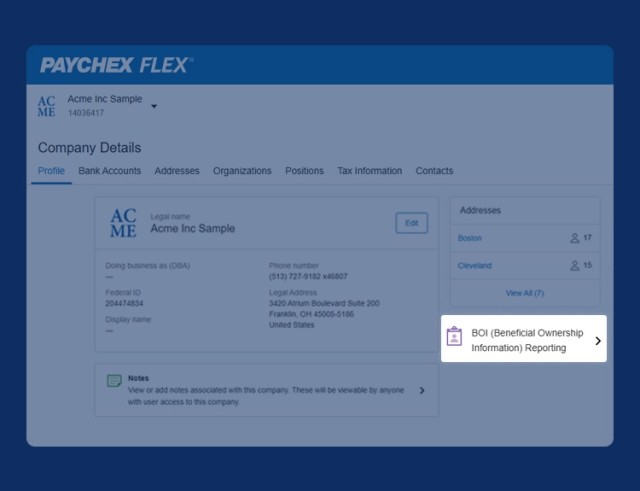

Current Paychex Clients Can Access BOI Reporting in Paychex Flex®

Current Paychex clients can easily access the BOI Reporting service in their Paychex Flex dashboard. Only Super Admins can activate the service.

In the dashboard’s left navigation bar, select:

- Company Details

- BOI (Beneficial Ownership Information) Reporting

- Get Started

New Federal Reporting Requirements in 2025

Business Requirements

Most businesses must report their beneficial owners. A beneficial owner is someone who has a stake of 25% or more in a legal entity or corporation, or a significant management role. A business may have multiple beneficial owners that own or control the company.

BOI Reporting Deadlines

FinCEN extended the BOI reporting deadline for some reporting companies to March 21, 2025, to file their initial, updated, or corrected report. Other businesses that previously were given deadlines after March 21 should adhere to the later deadline.

Penalties for Non-Compliance

As of Feb. 27, 2025, FinCEN said that businesses that fail to file or update their BOI reports by the current deadline will not be issued fines or penalties until a new interim rule takes effect with new deadlines.

Frequency of BOI Reporting

If there is a change in beneficial owner information, an amended report must be filed no later than 30 days after the date of the change. The Paychex BOI Reporting Service can take this added burden off your business to further assist you with your reporting obligations.

BOI Reporting FAQ

-

Can Paychex Clients Access the BOI Solution in Paychex Flex?

Can Paychex Clients Access the BOI Solution in Paychex Flex?

Yes, and if you are interested in our BOI Reporting solution, it's easy to find in Paychex Flex®. Only Super Admins can activate the service. Please have your super admin login to Paychex Flex. In the Dashboard's left navigation bar, select Company Details > BOI (Beneficial Ownership Information) Reporting > Get Started.

-

What Are the Reporting Company Requirements?

What Are the Reporting Company Requirements?

The U.S. Department of Treasury’s Financial Crimes Enforcement Network (FinCEN) requires most domestic and foreign businesses who are registered to do business in the U.S. to report their BOI starting in 2024.

All corporations, LLCs (Limited Liability Company), or other businesses who file documents with the Secretary of State (or similar office) are included in this requirement. -

Who Needs to File a BOI Report?

Who Needs to File a BOI Report?

Companies are required to identify and report beneficial owners in a BOI report and may also need to include information on the reporting company. Typically, the responsibility of filing does not fall on the individual.

-

What Companies Are Exempt From BOI Reporting?

What Companies Are Exempt From BOI Reporting?

There are 23 exemptions to BOI reporting. Paychex can help to determine if your business meets the criteria for an exemption.

Get Help Filing Your BOI Reporting

Paychex can help your business with these federal reporting requirements by filing initial and updated BOI reports on your behalf.