With SECURE Act 2.0, There’s Never Been a Better Time to Start a Retirement Plan

Get Started Now

Fill out our form and we’ll contact you to discuss how a Paychex 401(k) plan can benefit you and your business.

With SECURE Act 2.0, Your 401(k) Plan Can Be Virtually Free

For qualified businesses, SECURE Act 2.0 tax credits can cover 100% of plan start-up costs. That means your plan could be virtually free the first three years. These start-up tax credits are up to $5,500 per year1 for the first 3 years. An employer contribution credit may also apply, which is up to $1,000 per employee for 5 years.2

The Nation’s Number 1 401(k) Plan Provider3

- Attract and retain great employees. Hear what one of our clients has to say.

- Save time so you can focus on your business.

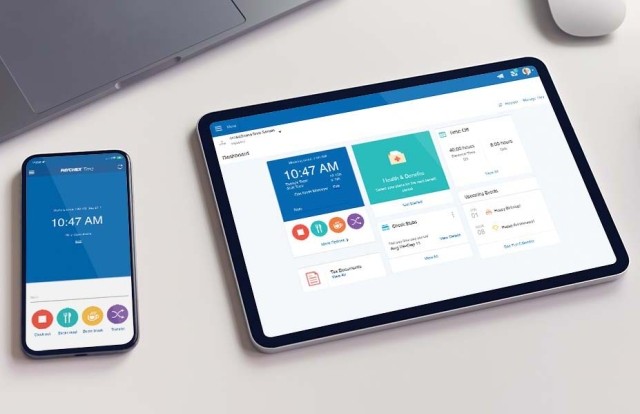

- Easy access to your plan via our online platform and mobile app.

- Satisfy state retirement mandates. Find out what your state requires.

- Secure, stable company that will help you navigate the SECURE Act and complex retirement issues.

Affordable 401(k) Plans for Any Sized Business

Whether you have one employee or 100, we can help you find the right retirement plan for your business. Help your employees achieve their retirement goals while putting tax savings in your company’s pocket.

Some of the options available through Paychex include:

PEP or Traditional 401(k)

<a href="https://www.paychex.com/retirement-services/pooled-employer-plans">Pooled Employer 401(k) Plan</a>

<p>Less Work and Lower Cost</p>

Traditional 401(k)

More Control

Reduced administrative costs. Economies of scale.

Potentially higher administration costs than a PEP.

The Pooled Plan Provider (P3) significantly reduces plan set-up responsibilities, including contracting with vendors and the investment manager.

As plan sponsor, the employer is involved in set-up such as plan design, choosing investments, and coordinating with vendors.

The P3 is the Plan Sponsor and relieves the employer of significant fiduciary liability.

The employer has more control but also more fiduciary risk.

The P3 assumes responsibility for audits, potentially saving employers $10,000-$20,000.

The employer of a large plan must oversee and pay for costly audits.

Up to 100% coverage of retirement plan start-up costs for qualifying businesses – a potential savings of up to $16,500. Eligible businesses that choose to give matching or profit-sharing contributions to their employee retirement plan may also qualify for an additional $1,000 tax credit of up to a maximum of $1,000 per employee. This additional employer contribution tax credit is eligible for 5 years from the 401(k) plan start date.2

Up to 100% coverage of retirement plan start-up costs for qualifying businesses – a potential savings of up to $16,500. Eligible businesses that choose to give matching or profit-sharing contributions to their employee retirement plan may also qualify for an additional $1,000 tax credit of up to a maximum of $1,000 per employee. This additional employer contribution tax credit is eligible for 5 years from the 401(k) plan start date.2

The Importance of Offering a Retirement Plan

A large percentage of Americans are not building up the assets they need to maintain their standard of living when they retire. The problem is only getting worse for younger generations.

Nearly

1/4

Without Retirement Savings

About 1/4 of non-retired adults in the U.S. do not have any retirement savings4.

$93,000

Household Retirement Assets

The median of total household retirement savings among all workers in 20205.

13 years

When Social Security is projected to run out

The Social Security Trust Fund is projected to be fully funded through 2034.6 After that, payments may be partial, but not at 100%. Employees may need to make up the difference.

94%

Employees interested in a 401(k) plan

94% of employees are interested in a 401(k) plan, second only to health insurance7.

The Simpler Way to 401(k)

Offering a 401(k) plan to your employees doesn't have to be complicated. As the provider for the largest number of 401(k) plans in the country3, Paychex has 401(k) administration down to a science. Our integrated payroll and benefits solution streamlines plan management and controls costs. With online enrollment, cloud-based account access, and support from retirement specialists, you and your employees can start saving today.